UK’s Lifetime Allowance for Pensions

05 June, 2020

Pensions are generally a very tax-efficient way of saving for your retirement.

However, if your UK pension savings is currently worth more than £1,073,100, or may be worth at least that much in the future, you may need to protect your pension savings from the UK’s Lifetime Allowance tax charge.

What is the UK’s Lifetime Allowance?

The UK’s Lifetime Allowance is the amount of savings you can take from your UK pension savings without facing a UK tax charge (which applies irrespective of the fact that you are no longer a UK resident and/or taxpayer).

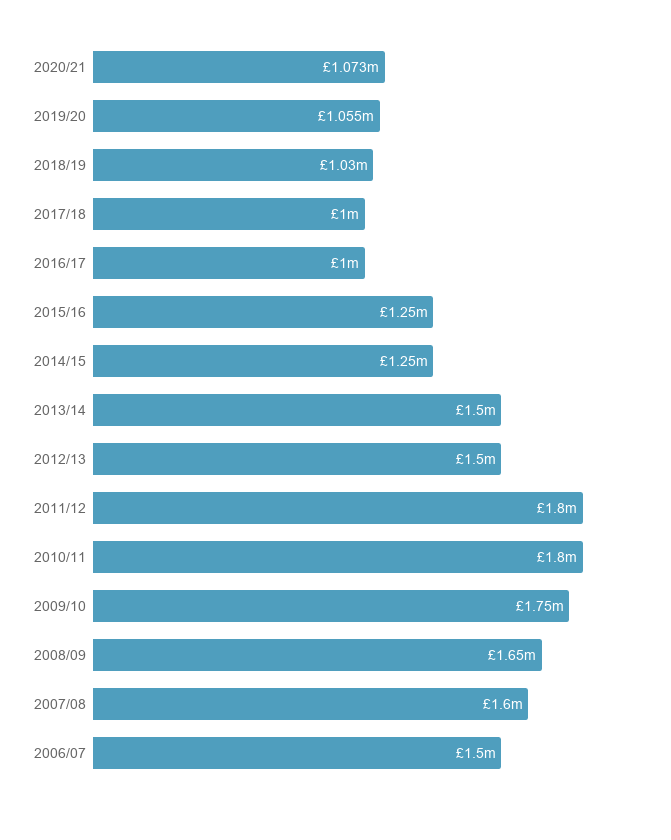

It was introduced on 6 of April 2006 and was initially set at £1.5M for the 2006/07 tax year. The Lifetime Allowance rose each tax year up to £1.8M in the 2010/11 tax year, but since then has progressively been lowered by the UK government. Since 5 April 2020, the standard Lifetime Allowance has been £1,073,100 and it had been expected to rise by CPI of £5,800 in 2021/22 (CPI increases have been applied since 2018). However, it was announced in March 2021 that the Lifetime Allowance will be frozen at its current level of £1,073,100 until April 2026.

The Lifetime Allowance is not a limit on the amount you can save in your UK pension, but when you are approaching the Lifetime Allowance you should consider what the UK tax treatment could be.

By taking early steps to manage your Lifetime Allowance, including obtaining financial advice where necessary, you can seek to mitigate the impacts of the tax charge on your pension savings. In some circumstances, individuals have certain protections against the Lifetime Allowance, or are granted a Lifetime Allowance greater than the standard Lifetime Allowance.

UK Lifetime Allowance Limits

What counts towards the Lifetime Allowance?

All of your UK registered pensions count towards the Lifetime Allowance – except the UK State Pension – and include any or all of the following:

The value of any defined contribution/money purchase pension plans.

- The value of any defined benefit plans. This will be calculated by the scheme, but is usually 20x the value of the annual pension.

- The value of any pension plans in payment before April 2006 that have yet to be tested against the Lifetime Allowance. This is usually 25x the pension in payment and only applies if you take other benefits after April 2006.

- In the event of death, any payment from a UK registered group life scheme.

Do you know the value of your combined UK pension savings?

The Lifetime Allowance applies to the value of your combined UK registered pensions. Your pension scheme administrator(s) may already send you information that will help you to find out the value of your combined pension savings. If not, you should contact your pension scheme administrator(s) for more information. This information will help you if you need to apply to protect your pension savings from the Lifetime Allowance tax charge.

If you have several UK pensions, transferring them into one plan could make it easier to keep track, although combining pensions is not right for all. Your existing UK pensions may have valuable benefits or guarantees you would not want to give up. We would recommend that you take financial advice before considering a pension transfer.

How much is the Lifetime Allowance Tax Charge?

The Lifetime Allowance tax charge differs depending upon how you draw your UK pension savings at retirement. The tax charge is currently:

- Lump Sum Payments = 55% of any amount you take from your pension savings as a lump sum that is over the Lifetime Allowance; or

- Pension Income Payments = 25% of any amount you take from your pension savings as pension income that is over the Lifetime Allowance

Testing against the Lifetime Allowance

You will only be tested against the Lifetime Allowance at specific points, as defined in UK tax legislation. These points are called benefit crystallisation events (BCE). The most common BCE is when you decide to draw from your UK pension savings, you will use up a percentage of your Lifetime Allowance. Other examples of when a BCE may occur include on death and at age 75.

What happens if you don’t take benefits from your UK pension(s)?

The Lifetime Allowance tax charge will still be payable if you die before taking your UK pension savings and have pension savings which are subject to the tax charge.

Protecting your UK pension savings

You may need to act to protect yourself from the Lifetime Allowance tax charge even if you aren’t near retirement.

You are currently able to apply to the UK’s HMRC for one or more of the protections available since the Lifetime Allowance was most recently reduced in April 2016. These protections are Fixed Protection 2016 and Individual

Protection 2016. Whether or not you apply for one or both of these protections will depend upon your personal circumstances and retirement savings plans.

You are able to apply for these protections on-line here!

Your pension savings may already be protected

The Lifetime Allowance was introduced in 2006 and was reduced in 2012, 2014 and 2016.

Each time the Lifetime Allowance has been reduced, the UK government has enabled people to apply to HMRC for Lifetime Allowance protection. By way of example, Fixed Protection 2016 provides a Lifetime Allowance of £1.25M as opposed to the current £1.73M. If you have applied for protection in the past, you should have received a certificate to confirm the protection.

However, you may still be subject to the Lifetime Allowance charge if you lose this protection (for example by not continuing to meet the requirements applicable to the protection sought).

Various protections that have been available are as follows:

- ‘Primary Protection’ (2006/07 tax year onwards)

- ‘Enhanced Protection’ (2006/07 tax year onwards)

- ‘Fixed Protection 2012’ (2012/13 tax year onwards)

- ‘Fixed Protection 2014’ (2014/15 tax year onwards)

- ‘Individual Protection 2014’ (2014/15 tax year onwards)

- ‘Fixed Protection 2016’ (2016/17 tax year onwards)

- ‘Individual Protection 2016’ (2016/17 tax year onwards)

There are also other circumstances where extra protection may be granted like a Lifetime Allowance Enhancement Factor relating to overseas situations or pension sharing on divorce. (Current as of June 2020)